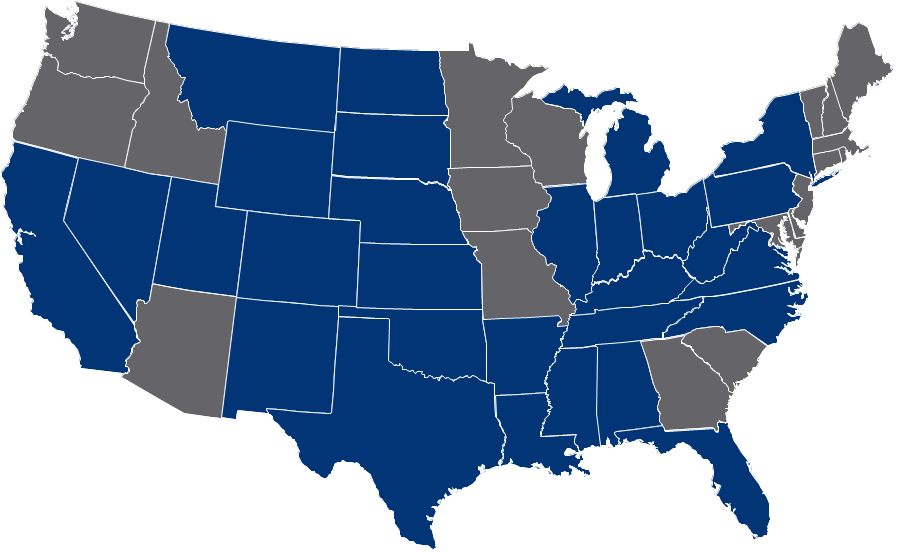

Overland Minerals and Royalties buys oil and gas rights across the United States. There are oil basins and reservoirs all over the U.S. The states below highlighted in blue are the most commonly well-known oil and gas plays in the United States. A few states we are especially interested in are North Dakota, Colorado, Wyoming, Texas, and Oklahoma. See below for how we value your oil and gas minerals and the process of selling your mineral rights.

How do you evaluate mineral rights?

Several factors need to be considered when determining the value of mineral rights or royalty interests.

- Location of the Property

Mineral rights are typically more valuable in areas where there is a higher accumulation of oil and/or gas that can be extracted from the land, and how often. The map shows the most common areas in the U.S. - Producing mineral rights

These are the easiest to value because the oil and gas is currently being extracted, processed, and sold based on actual production history. - Non-producing mineral rights

The value of these mineral rights of non-producing interests depends mostly on where they’re located and the timing of economic and governmental influences. - Oil and Gas prices

When oil and gas prices are high, the value of your royalty rights goes up. Likewise, when prices go down, the value of mineral rights goes down too. A low price per barrel means that other companies are not likely to invest in new wells or buy leases until prices rise again. - Lease Terms and Development

Lease terms are fundamental in determining how much you’ll get paid for your minerals. Oil and Gas leases dictate how long oil and gas operators have access to your minerals, how many wells can be drilled on them, and what kind of royalties you’ll receive. - Timing

Economic and governmental environments which influence oil and gas production also determine the price. - Number of Net Mineral Acres

Net mineral acres are typically determined in oil and gas leases. The number of Net Mineral Acres (NMA) is different than Gross Acres. The NMAs are used for evaluation.